Experience Matters.

Have you received the credits due to you yet?

Recovery Profitability

A variety of zero out-of-pocket cost tax credit programs are available and we know how to help you receive those for which you qualify. There are millions of dollars hiding and we know how to find, uncover, and recover your share. Every day you wait is hurting your bottom line. These benefits are yours and they're waiting for you. Reach out to us today.

Medical Underpayment Recovery

If you're a hospital or surgical center, there's a very good chance that you're owed additional money on your "zero sum" accounts, and we know how to recover it for you. We offer a free medical underpayment review that can result in millions more recovered from the insurance providers. We only get paid when it works. We have helped 100% of our clients in this space recover more (average recovery = 22%).

Corporate Benefits Initiative

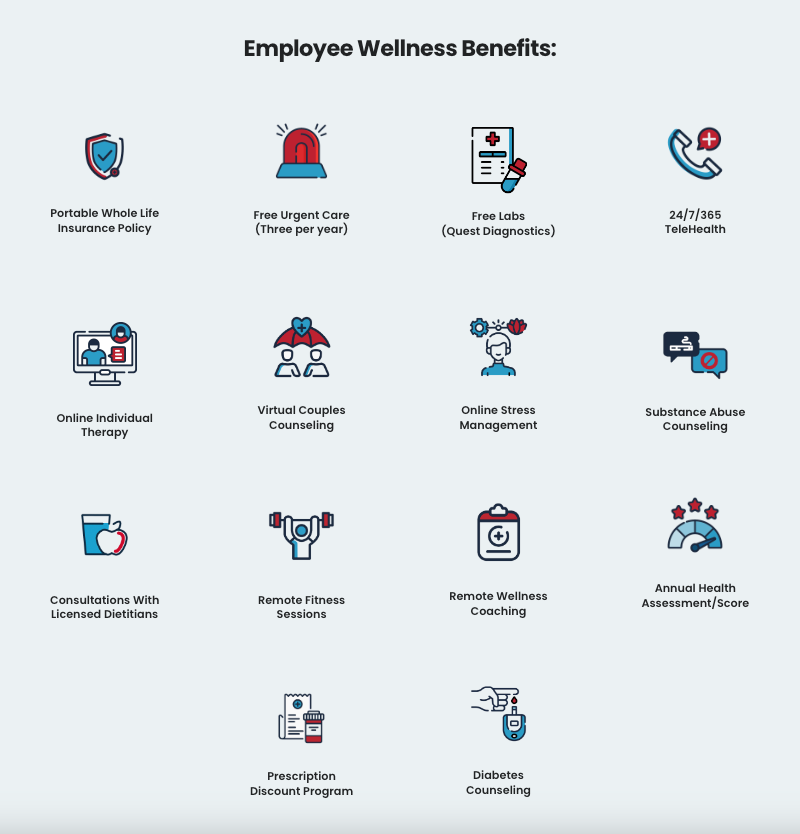

Some programs are so simple and powerful, the only reason more employers haven't done them yet is they haven't heard about them yet. A great example of this is The Corporate Benefits Initiative (CBI). If you're an employer, your employees can receive 15+ free benefits at zero net cost to you or to them. Designed to help them get more healthy in hopes of lowering the future costs of Medicare and Medicaid, the program doesn't cost you or your team members a dime. In fact, as the employer you are rewarded for offering it with a $500 average net FICA tax savings per employee every year.

The Corporate Benefits Initiative helps make the best practices of Fortune 500 Companies available to small and mid-size business owners. The program was founded on the premise that every business owner should take advantage of every incentive program that they are legally entitled to claim. Every employer should be offering this free benefit, for multiple reasons. We can help. Get started with us today!

How To Get Started:

The Overview Video:

Help your employees enjoy better physical and mental health and you'll cut down on turnover too (employers who use the CBI see a 40% average reduction in turnover). View the video found here to learn more about how this fantastic "no-net-cost" program works.

The Project Summary:

Click here to view a detailed write-up summarizing how the CBI works, the specific benefits your employees will receive, and how this program utilizes the IRS Section 125 Cafeteria Plan rules to help you win big, all with no net cost to you or to your team members.

The Website & App:

Visit our website at https://cbiplus.com then, to get started, click on "Learn More" then "Get Started Now" or just click here to fill out our initial application. Please be sure to include "Certainty Management" as the agent name and support@certaintyteam.com as the email.

The Onboarding Process:

Once you fill out the application, listed to the left, you'll be contacted by our team to help you complete the underwriting and onboarding process. It's very simple. We'll provide each employee with a free biometric app that makes maintenance and benefit use very easy.

Any questions? Reach out to us at 888-684-3122 or schedule a time to meet with us in

person below. We're here to help and look forward to meeting with you soon.

Self-Employed Tax Credit

Did you have self-employed income in either 2020 or 2021. Were you a 1099 independent contractor during this time period? If so, you may qualify for the extraordinary Self-Employment Tax Credit (SETC).

Qualify and you could receive up to $32,220.

There's zero up-front or out-of-pocket cost to you to apply for this generous tax credit. You keep 75% of whatever we can get for you and our team of Tier 1 tax credit recovery accountants keep the remaining 25%. (We personally receive a 5% finder's fee; most of it goes to the accountants).

We don't know how long this program will last so don't delay. Click here to apply today.

How Does It Work?

The Families First Coronavirus Response Act (FFCRA), as amended by the Tax Relief Act of 2020, is intended to help United States Citizens recover from COVID-19 by providing small businesses refundable tax credits that reimburse them, dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19. The FFCRA extends to self-employed individuals equivalent refundable tax credits against their personal net income tax.

To request assistance with any of these areas, please reach out to whomever introduced you to Certainty Management, call us toll free at (888) 684-3122, or schedule a time to meet with us at your convenience by clicking here.